Yesterday I showed a chart of UK property prices and compared these to the current bubble in gold and silver prices. UK property prices are now around 5.5 times average earnings – down from a high of 6.5 times at the top of the market in 2007, but well above the long-term average of 4.2 times average earnings. So, are UK prices sustainable at their current levels?

Since the 2007/8 financial crisis, home prices have fallen much more in other affected countries. Ireland – prices down 50%: US – down 28%: Spain – down 22%. But in the UK and Italy prices are only down by around 10%.

Factors keeping UK prices up are the growing number of households due to immigration and divorce and a shortage of supply due to planning restrictions – Ireland, Spain and the US all had huge construction booms before the 2007/8 crash which led to an oversupply. There are also the Coalition’s desperate attempts to keep interest rates down and to shore house prices up till the next election in the hope that property price stability will win them votes.

There’s also an effect called “anchoring” which is shoring up prices. When prices of something increase, people get used to the higher price levels and see these as the “new normal”. And anyway, UK property prices seem to be increasing again. So, why worry?

Here are UK prices again:

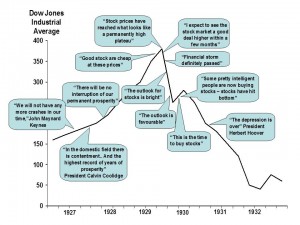

And here’s a chart of US stock prices before and after the great 1929 crash:

You’ll notice two things. 1. There are always lots of experts “talking up” the market 2. On the way down shares started to rise again. This is what’s called a “Fools’ Rally” – people have become so used to the “new normal” (higher prices) that they assume a 10% to 20% drop provides a wonderful buying opportunity. Invariably they are wrong.

House prices are always much “stickier” than share prices or gold prices so will respond much more slowly whether rising or falling than something like shares or gold which can quickly be bought or sold. And it’s almost certain house prices will continue to rise up till the 2015 election as the Coalition tries to create the illusion of economic stability while our national debt shoots up to unsustainable levels. So, no problem there.

But can property prices continue to defy gravity when Ed “borrow-borrow” Balls becomes chancellor and we have a massive financial crisis when the interest we pay on our national debt shoots up as markets lose confidence in chancellor Balls’s economic management? I don’t think so.

So, if you want to downsize, the next couple of years are the perfect time to do it. If you want to buy a bigger property, I believe you should wait 800 to 900 days to see how the dust settles after the delusional, buffoon Balls takes over.

There are a few of factors that are keeping prices high. Firstly there is massive immigration, and they don’t bring thier houses with them ( maybe a few Roma do) House builders have difficulty raising money to build as the banks don’t want to lend (unless the odds are stacked very heavily in their favour). And then there is a shortage of both buyers and sellers, which tends to stagnate prices. Many people are on interest only mortgages and if they move they’ll have to switch to repayment, and many people also are on low base rate trackers and do not satisfy lenders criteria ( cos the lied on thier previous applications) and are also stuck where they are. I think the crash will come when rates creep up, repossesions will go through the roof, however the govt will want to keep rates low as they owe so much money. It’s a difficult one to call. I think the real signal will be if govt debt decreases dramatically ( not any time soon) then rates will rise and carnage will ensue.