Our clueless, expenses-thieving politicians and their sycophantic, careerist ‘advisers’ (actually just the next generation of self-serving, professional politicians) are completely clueless about what to do as public spending spirals up out of control and tax revenues plummet.

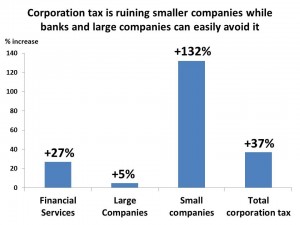

One part of the answer can be found in the simple diagram below. This shows that during the 1997-2007 Brown/Balls boom, the tax paid by small companies (SMEs) shot up by 132%. Yet while making massive profits, the tax paid by financial services companies only went up by 27% and tax paid by our largest, usually multinational companies, only crept up by a pathetic 5%. The reason for such a gap between the increase in SMEs’ tax compared to that of financial services and largest companies is that SMEs cannot use all the tax avoidance tricks used by banks and multinationals.

I’ve written before that most taxes only have a brief usual life before those being taxed find ways to avoid paying them. In the past we’ve had hearth taxes, beard taxes, window taxes and hat taxes. All were abandoned when people changed behavious and revenues fell. I believe that Corporation Tax is also past its useful shelf-life. It is an unfair burden on Britain’s 4.5 million SMEs while larger companies can almost ignore it. It’s time to scrap Corporation Tax and replace it by a tax on all business activities conducted in the UK – basically, the Government should retain part of VAT normally reclaimed by businesses. Then companies would be forced to pay tax whether they claim to be based in Jersey, the Cayman Islands or on the Moon.

Why are our politicians too stupid to understand this? Perhaps you could forward this link to your MP?